IFCO predicts rise in e‐grocery market

FRESH PLAZA | Publication date: 1/18/2017

The German and European food markets are undergoing intense changes, consumers have more sophisticated needs than before and at the same time want to spend less time for shopping.

High Growth Rates / Examples in Europe and Germany

In 2015, about 4% of all food purchases in France and 5% in the United Kingdom were made by internet, whereas in Germany it was only 0.6%. By 2015, only one fifth of all German consumers had ever bought food items online, but the scenario is changing rapidly, and within the food segment the percentage of fresh produce is growing.

German consumers spend over 170 billion euros yearly for groceries, but so far less than 1% of the total turnover is generated through e‐commerce. For the next ten years, however, the market research institute GfK expects a real boom of the on‐line food business in Germany. According to a GfK study from last year, food and drugstore items belong to the fastest growing on‐line segments. By 2025, the on‐line business could make up for about 16% of all food sales in Germany.

Amazon, having already started e‐grocery activities with fresh produce in the UK, Spain, and Italy, recently entered also the German fresh market, although for the time being the offer is limited to very few big cities and to customers with an Amazon Prime account. A German‐wide availability for all consumers via Amazon Fresh is still pending, but the traditional retailers are closely following every step of their giant US competitor on the German market.

Rewe was one of the first big players on the German market to extend its activities to e‐grocery, including fresh produce, and the first German online supermarket with an own delivery fleet. Also Kaiser Tengelmann’s online supermarket ‘Bringmeister’ offers fresh products, though the service is restricted to the Berlin and Munich areas.

Consumers’ Expectations and Logistic Challenges

What is driving the growth of e‐grocery? One important factor is certainly a general change in purchasing behavior, as today’s younger generations have grown up with computers and simply extend their shopping habits to grocery items. Also the so‐called baby boomers, born between 1945 and 1964, who look for time‐saving options to make their lives more convenient, are among the potential heavy users of e‐grocery offers. The continuing internationalization and increasing digitalization of the retail market are further strong drivers, as European supermarket chains follow the example of their international competitors in other countries.

A basic expectation of internet customers – apart from reliable logistics – is a responsive customer service channel, for example via social media or chat boxes. According to a recent enquiry conducted by the market research institute Ipsos, most consumers consider the personalized customer attention as a critical point. To attract and retain customers, many online supermarkets offer value added services, such as recipes, saved shopping lists, product suggestions, lists of frequently purchased products, etc. The strict hygiene and cooling requirements for fresh produce are one of the main challenges for e‐grocery. This, in turn, leads to a need to carry out an order quickly and accurately, and then deliver within a small window of time, whether through manual order fulfillment at retail outlets or other approaches such as sophisticated automation. A fast pick‐up time is important also in view of the increasing number of competitors in the e‐grocery market. More and more consumers expect same‐day delivery without surcharge. For example, in the UK, Tesco experienced a clear increase in sales after having eliminated the pick‐up charges for e‐grocery orders.

A crucial point when it comes to fulfilling consumer and market requirements is offering enhanced service while keeping costs at a reasonable level, which to a large extent depends on the logistic organization.

Logistic Processes

With regard to the execution of online orders, there are several logistic and transport options, from an own delivery service to cooperation with established service providers like DHL. Also Click & Collect plays an important role, combining online ordering and then picking the order up at a local retail outlet or other convenient location. Such an

approach greatly aids retailers looking to minimize their delivery costs by avoiding individual household deliveries, and is popular with many consumers as well, especially in the French and UK markets as an early adopters of the Click & Collect system.

To date, most grocery e‐fulfillment is performed manually by professional shoppers at retail outlets or dedicated ecommerce fulfillment facilities – the “Dark Store”. On the positive side of manual order fulfillment, capital investment in automation is avoided. The manual approach is expensive, with online orders generally involving considerable travel time for professional shoppers as they traverse the aisles to fulfill their customer orders.

The alternative to manual order picking is automated order fulfillment: Flexibility is a critical concern as wide eyed retailers watch e‐grocery grow. A key approach is for the automated system, whether conveyor, robot or other approach, to bring the goods to the picker. Such systems have become increasingly robust, with better design for productivity and ergonomics.

One of the pioneers in the EU was Tesco who, in 2013, marked a switch from professional shoppers to an automated goods‐to‐person approach. This kind of system is usually applied in a “Dark Store” or warehouse.

How RPC Can Support the Logistic Process

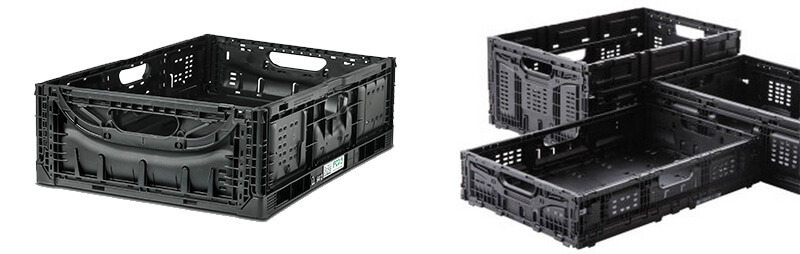

With the strong growth of e‐grocery expected for the forthcoming years, it is highly probable that logistics will reach

a higher degree of automation to cope with the challenge of flexibility and speedy delivery. In this respect, reusable

plastic containers may play an important role provided that logistic processes are coordinated in an adequate way.

IFCO, expects an increase in the use of RPCs also in the e‐grocery segment and is ready to support its clients by developing customized solutions for order picking and delivery on the basis of standardized RPCs. In doing so, the company works hand in hand with the retail organizations and logistics providers to address the new requirements for segments like fresh fruit and vegetables and other industries.

For those retailers who opt for an automation of their e‐grocery business, RPCs can be helpful as standardized measurements and easy handling of the crates facilitate the optimization of order fulfillment processes, while the robust material ensures the protection of the goods during transport. IFCO has a generally positive attitude toward food e‐commerce and looks to offer solutions for appropriate packaging solutions also for on‐line orders, depending on the requirements of customers and suppliers. Upon demand, for example, IFCO develops RPCs with the logo of the retailer, both for home delivery and collection by the consumer. The logistic process is very simple: The final customer either returns the RPCs to the shop himself or hands them over to the driver when the next delivery is made.